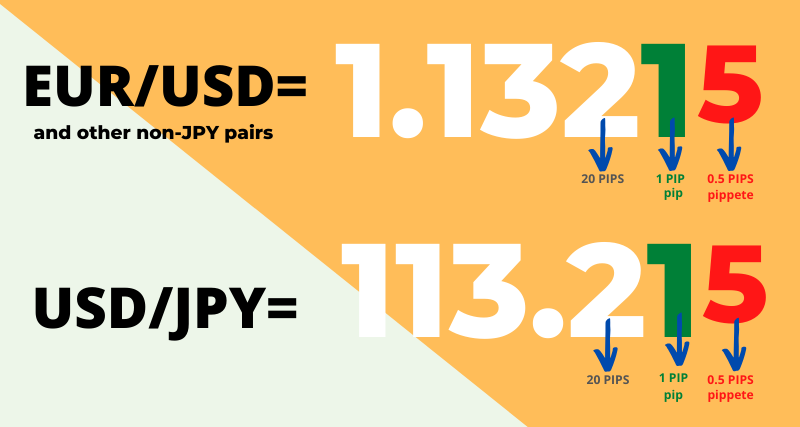

Similarly, if you are trading Japanese Yen pairs or any pair where a pip is the second decimal number, you would have to divide a pip by the quote currency rate. For example, if the GBP/JPY price is at , each pip would be worth ( / x 10,) approximately British Pound 09/08/ · To find the pip value when the USD is listed as the base currency, as in USD/JPY or USD/CAD, for an account denominated in U.S. dollars, divide the above-listed standard pip values per lot by the Estimated Reading Time: 9 mins 11/06/ · Pips in Red, Points in Blue Buy at 65 5 Sell at 85 6 This is a gain of 20Pips and 1 point I think the JPY pairs measure pips like this: Buy at 12 1 Sell at 12 1 This is a gain of Pips The "pip" is the measurement of the 4th decimal place, or 2nd in JPY Pairs EUR/USD USD/JPY

20 Pips GBPJPY Scalping Forex Trading Strategy

Dollar, and the quote or counter currency is the Japanese yen. The pair expresses how much JPY one would need to buy one USD. The exchange rate is seldom stable and fluctuates by a few pips. S dollar. Of course, the best time to trade USDJPY is during the USD trading session. The USD came into circulation before the yen. While the former was made available in Aprilthe latter surfaced in July The yen was made official jpy forex pips June 27,when the Meiji government.

However, retail traders usually trade jpy forex pips micro lots or 0, jpy forex pips. In the Forex market, pip denotes the point movement in the exchange rate of a currency pair. It is generally the commission that your broker charges from you. To calculate the USDJPY pip value for 1 standard lot size, you need to divide and USDJPY current rate. For example, if the current exchange rate USDJPY is To calculate 1 mini lot USDJPY pip value, you need to divide and USDJPY current exchange rate.

To calculate 1 micro lot USDJPY pip value, you need to divide 10 and USDJPY current rate. If traders trade 1 micro lot, 1 pip, or 0. If traders trade 1 mini lot, 1 pip or 0. USD JPY lot size for 1 pip or jpy forex pips. So why is it so complicated to calculate 1 pip of USDJPY forex pair?

In this currency pair, jpy forex pips, the value of one pip is 0. Jpy forex pips multiplying it by the 1K lot, that is ; you get 10 yen. To find out the value of jpy forex pips dollar against 10 yen at the current exchange, use the following method :. This also portrays that the currencies in a pair are interconnected, and if the yen falls, its pair will also fall, jpy forex pips.

If this happens, the pip value will become half of where it stands per the current exchange rate To make this work, 10 yen will be divided by the latest exchange rate Many traders and investors face losses because they make those minor calculation errors.

You can avoid this problem if you work with a broker who offers a comprehensive trading platform where the AI calculates, jpy forex pips. Let us also assume that this trade made you hit a profit target of pips at the exchange rate o However, we can get the correct answer following the other way. Take The result will give you 2. Multiply the result by This will provide you with a profit of 33, yen, jpy forex pips. We can use the current pip value as an estimate but never as the actual value.

The pip value fluctuates when we make the USD calculations, but it remains the same in JPY. This is why all the estimates should be made in the quote currency. This might still seem a lot for small traders. Leverage allows you to operate more capital in the market that you own.

Various Forex brokers offer additional leverage, which generally lies between to Suppose Leverage can vary significantly from instrument to instrument and country to country. For example, the U. only allows maximum leverage of The value of any currency can never be wholly separated from the condition of its respective country. Numerous economic and non-economic activities can strengthen and devalue the currency. The monetary policies are the policies set by the central or federal bank of a country.

The Federal Reserve of the United States FED is responsible for implementing these policies, while the Bank of Japan does the same for its country. Any change made by these two entities regarding quantitative easing, economic growth forecasts, inflation, and the rate of jpy forex pips, the currency pair becomes volatile.

Economic jpy forex pips are essential for Forex brokers and traders because they highlight the health of the economy. These indicators tell if the economy is leading, lagging, or is stable. There are many economic indicators, but ones that directly impact the exchange rate are the gross domestic product GDPjpy forex pips, interest rate, wage growth, retail sales, consumer price index CPIunemployment rate, industrial production, and wage growth.

Any fluctuation in these indicators can lead to the appreciation or depreciation of the currencies. However, you must know all about the currency pair before holding any position. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us.

Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. What is the Velocity of Money? Problems in Capital Market! Related posts: How to Calculate a Pip Value? How to Calculate Pips on Silver? Calculate Crude Oil Lot Size — How to Read Oil Pips How to Calculate Lot Size in Forex?

How to Calculate Equity Multiplier? How to calculate number of periods for an annuity? How jpy forex pips Calculate Weighted Average Price as Trader? How to Calculate Company Valuation? What does 0. Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world, jpy forex pips. Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex?

Are PAMM Accounts Safe? Stock Exchange Trading Hours, jpy forex pips. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us, jpy forex pips.

Forex social network RSS Twitter FxIgor Youtube Channel Sign Up, jpy forex pips. Get newsletter. Spanish language — Hindi Language.

How To Calculate Pips for USDJPY, GBPJPY, EURJPY

, time: 5:48EURJPY Pip Calculator | Myfxbook

GBPJPY Pip value. The pip value of 1 standard lot, or , units of GBPJPY is $ The pip value of 1 mini lot, or 10, units of GBPJPY is $ The pip value of 1 micro lot, or 1, units of GBPJPY is $ The pip size of GBPJPY is , so with the current GBPJPY price of 09/08/ · To find the pip value when the USD is listed as the base currency, as in USD/JPY or USD/CAD, for an account denominated in U.S. dollars, divide the above-listed standard pip values per lot by the Estimated Reading Time: 9 mins What are Pips. A Pip in forex means the smallest price change a currency pair can make, except for fractions of a pip or 'pipettes'. For most currency pairs 1 pip is ; for currency pairs with the Japanese Yen such as USD/JPY 1 pip is When trading metals, 1 pip for Gold and Silver is

No comments:

Post a Comment