22/05/ · Moving up to Mini Lots. Before micro-lots, there were mini lots. A mini lot is 10, units of your account funding currency. If you are using a dollar-based account and trading a dollar-based pair, each pip in your trade would be worth about $Estimated Reading Time: 5 mins What are Lots. In forex a Lot defines the trade size, or the number of currency units to be bought or sold in a trade. One Standard Lot is , units of the base currency. Most brokers allow trading with fractional lot sizes down to or even less. Fractional lot sizes are sometimes referred to Contract Size per Lot: 1: Minimum Lot Size: Price Minimum Increment: Pip Value per lot: Hedged Margin, % Swap Short

Your Guide to Forex Lot Sizes: Mini, Micro, and Standard Lot - Pro Trading School

He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician CMT. He is also a member of CMT Association, minimum lot size for forex gold usd. When you first get your feet wet with forex trainingyou'll learn about trading lots.

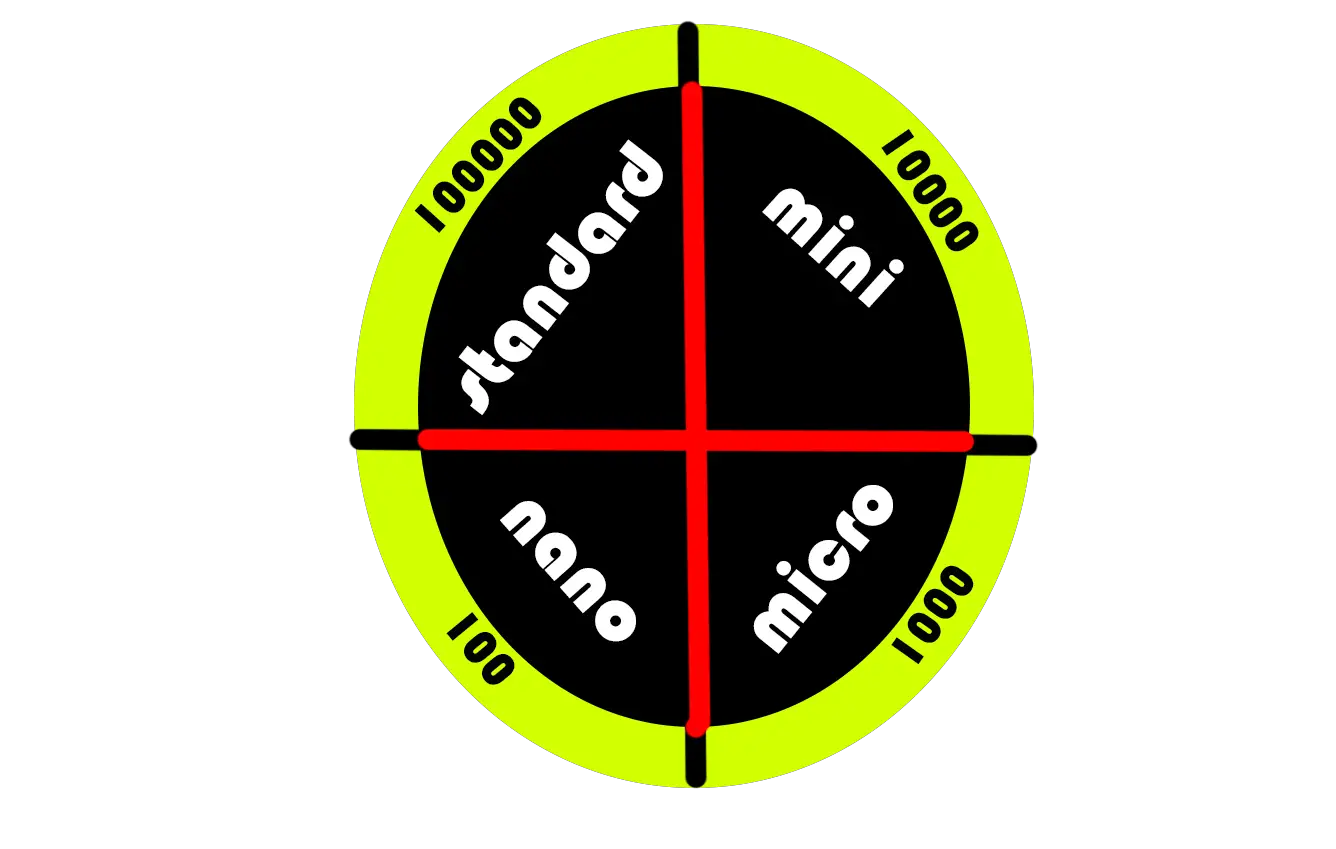

In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. It is important to note that the lot size directly impacts and indicates the amount of risk you're taking. Finding the best lot size with a tool like a risk management calculator or something similar with a desired output can help you determine minimum lot size for forex gold usd best lot size based on your current trading account assets, whether you're making a practice trade or trading live, as well as help you understand the amount you would like to risk.

The trading lot size directly impacts how much a market move affects your accounts. For example, a pip move on a small trade will not be felt nearly as much as the same pip move on a very large trade size. You will come across different lot sizes in your trading career, and they can be explained with the help of a useful analogy borrowed from one of the most respected books in the trading business. Micro lots are the smallest tradeable lot available to most brokers.

A micro lot is a lot of 1, units of your account funding currency. If your account is funded in U. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents. Before micro-lots, there were mini lots. A mini lot is 10, units of your account funding currency. If you are a beginner and you want to start trading using mini lots, make sure that you're well-capitalized. It's up to you to decide your ultimate risk tolerance.

A standard lot is a ,unit lot. So most retail traders with small accounts don't trade in minimum lot size for forex gold usd lots. Most forex traders that you come across are going to be trading mini lots or micro-lots. It might not feel glamorous, but keeping your lot size within reason relative to your account size will help you preserve your trading capital to continue trading for the long term. If you have had the pleasure of reading Mark Douglas' Trading In The Zoneyou may remember the analogy he provides to traders he has coached, which he shares in the book.

In short, Douglas recommends likening the lot size that you trade and how market moves would affect you, to the amount of support you have under you while walking over a valley when something unexpected happens. To illustrate this example, a very small trade size relative to your account capital would be like walking over a valley on a very wide, stable bridge where little would disturb you even if there was a storm or heavy rains.

Now imagine that the larger the trade you place the smaller and riskier the support or bridge under you becomes. When you place an extremely large trade size relative to your account balance, the bridge gets as narrow as a tightrope wire, such that any small movement in the market would be like a gust of wind in the example, and could send a trader the point of no return.

The forex market is less regulated than other markets, so requirements like minimum account size are typically set by brokerages. The first step in calculating forex profit is to measure the movement of the pair. Multiply that profit by your lot size and number of lots. Trading Forex Trading.

Table of Contents Expand, minimum lot size for forex gold usd. Table of Contents. Lot Size Matters, minimum lot size for forex gold usd. Trading Minimum lot size for forex gold usd Micro Lots. Moving up to Mini Lots. Using Standard Lots. A Helpful Visualization. Minimum lot size for forex gold usd Asked Questions FAQs. By John Russell Full Bio LinkedIn John Russell is an expert in domestic and foreign markets and forex trading.

He has a background in management consulting, database administration, and website planning. Today, he is the owner and lead developer of development agency JSWeb Solutions, which provides custom web design and web hosting for small businesses and professionals. Learn about our editorial policies. Reviewed by Gordon Scott. Article Reviewed June 29, Learn about our Financial Review Board.

Article Sources.

XAUUSD Scalping Strategy

, time: 9:53Choosing a Lot Size in Forex Trading

05/07/ · Minimum lot size for forex gold usd. The maximum position a client may hold at any given time is 10, troy ounces for spot gold and, troy ounces for spot silver 6/3/ · The best way to count pips on gold on Metatrader is to remember that $1 is 1 micro lot for pips target 22/05/ · Moving up to Mini Lots. Before micro-lots, there were mini lots. A mini lot is 10, units of your account funding currency. If you are using a dollar-based account and trading a dollar-based pair, each pip in your trade would be worth about $Estimated Reading Time: 5 mins Contract Size per Lot: 1: Minimum Lot Size: Price Minimum Increment: Pip Value per lot: Hedged Margin, % Swap Short

No comments:

Post a Comment