Market depth refers to the market liquidity for a security based on the number of standing orders to buy (bids) and sell (offers) at various price levels 24/11/ · Most retail Forex brokers don't offer the statistics needed to determine Forex market depth. It's not that the broker is necessarily holding back any information. The answer is actually in the nature of the business and the market itself. The Forex market is a decentralized place, it has no fixed centralized exchange where all data could be gathered. Thus, it is impossible to gauge the true market depth Estimated Reading Time: 3 mins What is Depth of Market? Depth of Market, aka the Order Book, is a window that shows how many open buy and sell orders there are at different prices for a security. Let’s say the current price is $1, the DOM will show how many orders there are at $, $, etc. It’s a great tool to see where the supply and demand levels are. How do I open DOM?

Market Depth in Forex Trading - Global Brands Magazine

Depth of Market, aka the Order Book, is a window that shows how many open buy and sell orders there are at different prices for a security. The data is streamed from the broker. The data in the DOM and the chart may be slightly different since various data sources are used.

By default data is shown in a semi-static format. This means that the price what is market depth in forex are fixed while the price moves within the shown range. The 5-second timer is the middle icon [7]. To place a market order simply click Buy Market or Sell Market, what is market depth in forex. The number shows how many securities will be bought or sold, you specify that at the top what is market depth in forex the DOM window [1].

It also syncs with the floating trading panel. You can place orders at a specific prices To buy — click the cell at a price you want in the left column, to sell — in the right one.

If you want to place a limit order, just click in the cell next to the desired price, if you want to place a stop order, hold the CTRL button on your keyboard and click the cell you want. If you want to turn this off, you can do so in the settings. Click the label with the number next to the DOM — this is your order label. You can then change any settings that you like, what is market depth in forex, and click MODIFY.

The limit level of such orders is duller in color, and the Stop level is more vibrant. If you are in a position on this symbol you either bought or sold someyour position size [13] will be shown as a number at the top of the DOM. If you bought in a long position the box will be blue, and if you sold in a short position it will be red. To close the position or reverse it, use the Flatten [8] or Reverse buttons at the bottom of the DOM. Start free trial.

Depth Of Market DOM What is Depth of Market? How do I open DOM? Connect to the account of the broker who supports Level 2 data TradeStation, CQG, AMP, Tradovate, iBroker, HitBTC or Alor. Click the DOM button on the right toolbar of the chart. DOM for the current security will open. Main parts of a DOM window explained.

Launch Chart.

TradingView - DOM (Depth of Market)

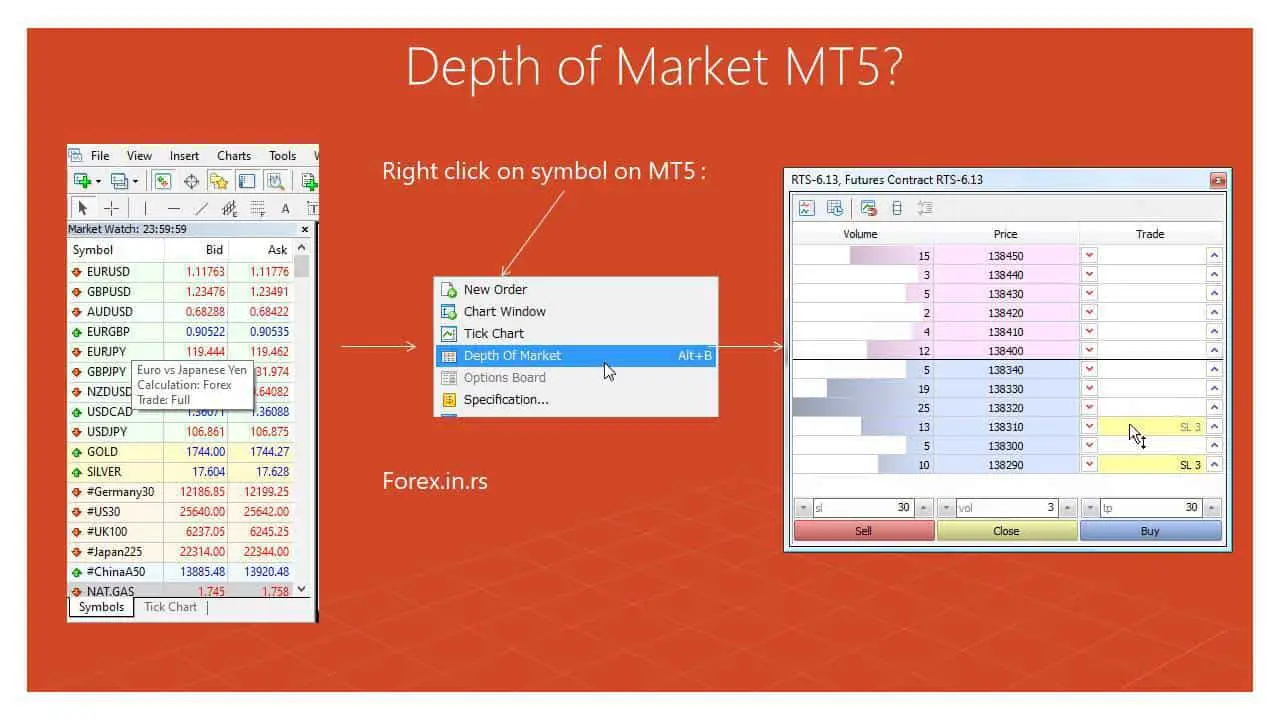

, time: 19:29What is Depth of market on MT5 - Forex Education

What is Depth of market on MT5. by Fxigor. When it comes to market mt5, it is noted that the depth of the market showcases bids. It also seeks to provide a specified instrument about the best prices currently considered the closest to the market’s blogger.comted Reading Time: 6 mins 24/11/ · Most retail Forex brokers don't offer the statistics needed to determine Forex market depth. It's not that the broker is necessarily holding back any information. The answer is actually in the nature of the business and the market itself. The Forex market is a decentralized place, it has no fixed centralized exchange where all data could be gathered. Thus, it is impossible to gauge the true market depth Estimated Reading Time: 3 mins What is Depth of Market? Depth of Market, aka the Order Book, is a window that shows how many open buy and sell orders there are at different prices for a security. Let’s say the current price is $1, the DOM will show how many orders there are at $, $, etc. It’s a great tool to see where the supply and demand levels are. How do I open DOM?

No comments:

Post a Comment